Scaling Grab's Merchant Experience

Expanding and scaling a suite of products dedicated to support South East Asian merchants across 7 countries.

Company: Grab Financial

Role: Lead Product Designer

Dates: June 2018 - January 2020

Technology: React Native applications (ADR and iOS), web responsive

Location: Singapore, Singapore

Overview

I was a the lead product designer for Grab Financial's merchant and digital goods product suites, managing a team of three designers for 5 products (B2B2C, B2B, and B2C) over 7 countries. Grab Financial is a fintech company that aims to provide financial services to underbanked mobile users. Over 60% of adults in South East Asia are unbanked or underbanked and Grab Finance seeks to bridge that gap.

Results

- Proposed and launched Online Acceptance, Grab's payment gateway, averaging $48M in monthly revenue (first quarter for single country launch). Product was financially critical during COVID.

- Identified opportunity space and created Merchant Central, Grab's merchant management platform. Collaborated with the VP of Banco de Oro to launch in the 2nd largest mall in the Philippines, scaling to 85 malls nationwide and expanded internally to manage GrabFood's merchants' needs.

- Launched the initial two digital products (airtime payments and bill payments), averaging $8M/mo and $16M/mo respectively, to establish a Digital Marketplace. Expanded to selling digital games, movie tickets and other products, using Online Acceptance. The Digital Marketplace intended to be the fore towards cryptocurrency opportunities.

Process

Merchant Mobile App

Locations: Singapore, Indonesia, Malaysia, Vietnam, Philippines

Improving the Usability of Merchant Mobile App Uncovered the Opportunities that Inspired Merchant Central

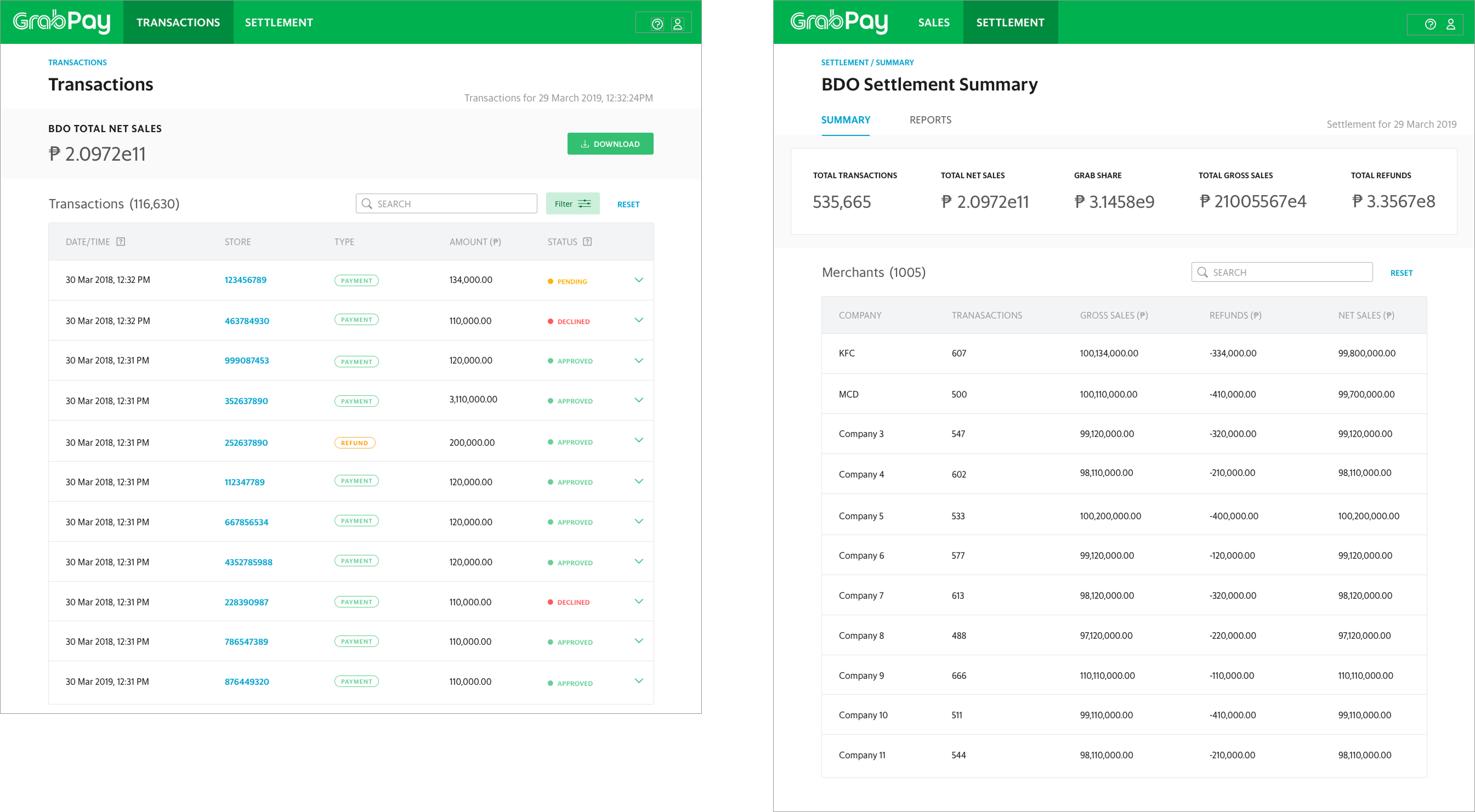

GrabPay's Merchant App tracked GrabPay transactions and earnings for its merchants. After running several usability tests, we learned that the original design mimicked a competitor application, but many of our merchants either found it unappealing or difficult to find the information they needed. More specifically, the hamburger menu design hid critical report information that our merchants needed for settlement.

As a result, I redesigned the application from a left side panel navigation to a bottom panel navigational. This resulted in an increase usage of our reports tab by 46%. This increase use, resulted in feedback during our usability sessions, surfacing several merchant needs that formed the foundation of two new products, Merchant Central and Digital Marketplace:

- Merchants needed a way to track all transactions across all their stores. Many were hiring outside bookkeepers to manage this specific task when working with Grab. This was costing our merchants extra money, but it was necessary to ensure their finances were correct.

- Merchants wanted to be proactive about refunds and invalid or failed transactions before they appeared in settlement. There was no easy way to manage this because the GrabPay app was a POS (point of sale) solution, not a business management solution.

- Merchants wanted to know their performance. Many of our merchants cared about the health of their business and were interested in being part of a community from a trusted source like Grab.

Merchant Central

Locations: Singapore, Vietnam, Philippines

Merchant Settlement Needs Inspired Merchant Platform

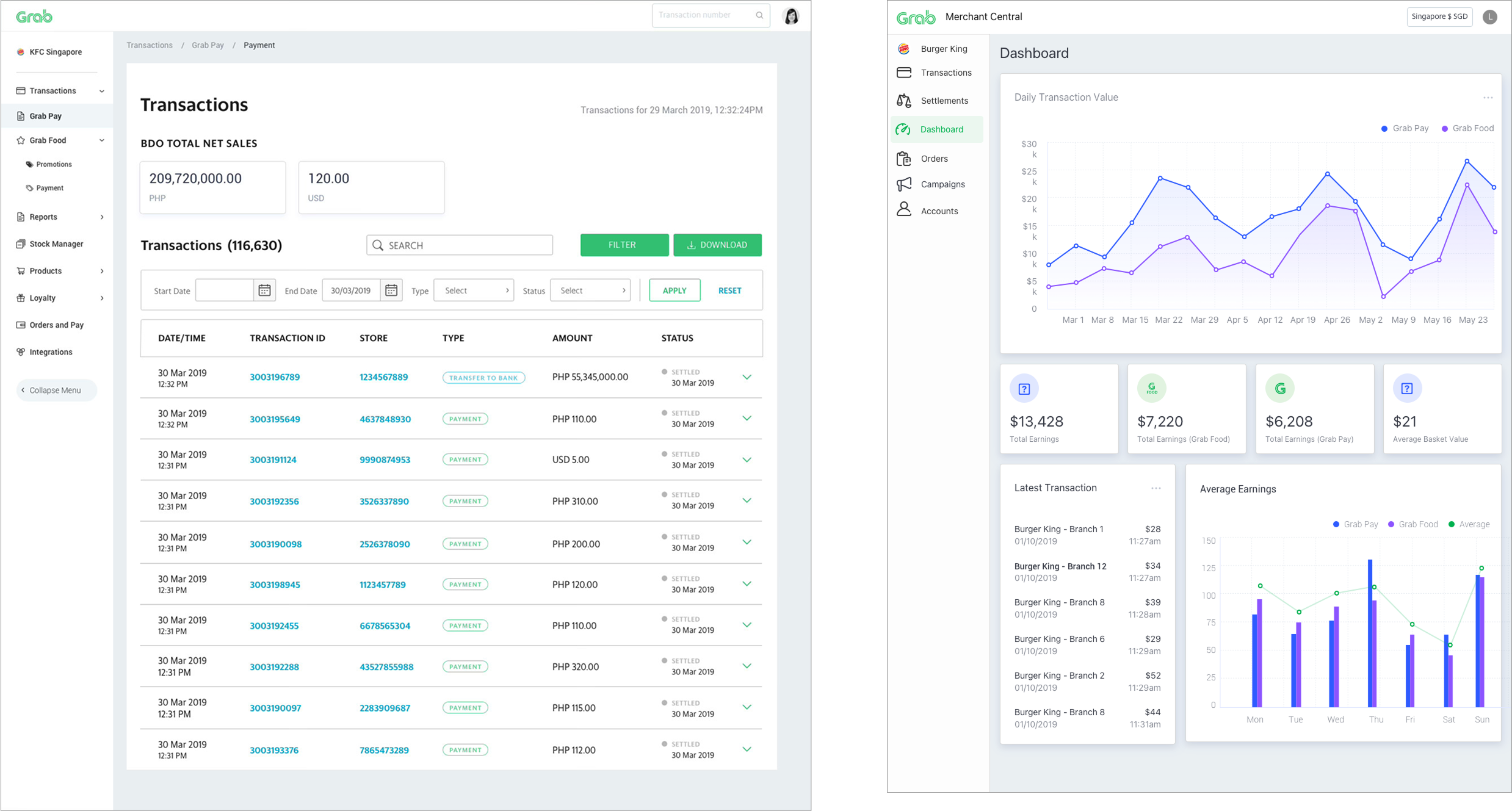

Merchant Central is a business platform that surfaces merchants' business performances on Grab (business reports for reconciliation, finance management), lookup actionable insights on how to grow their business, engage with customers, manages customer relationships (CRM), and incentivizes customers through campaign management. It addressed the merchant demand to access Grab-related business metrics on demand.

It's origins stemmed from feedback from merchant app usability testing and additional supporting exploratory research where we learned that merchants were struggling to manage their settlements with Grab. To solve this, we created a web responsive portal that provided a consolidated view of all GrabPay POS transactions for each merchants' stores with clear settlement information. This became a primary tool that our larger merchants grew to love.

MVP of merchant central launched in Vietnam with 1188 merchants purchasing the product. It was a soft launch with no dedicated marketing efforts. The goal was to see if merchants would buy the product on their own. They did with an 88% approval rating. Most of the criticism was that our merchants wanted more, leading to leadership growing the merchant team in the next quarter.

Merchant Platform Secured Trust with Banco de Oro and Supported GrabFood's Merchants' Needs

Our merchant team's focus on ensuring confidence with Grab's settlement process through Merchant Central, convinced the VP of Banco de Oro to partner with Grab. He had a specific team of three accountants who managed the books for their malls and had major concerns about settlement. The introduction and success of Merchant Central in Vietnam secured a major deal with the bank, leading to the use of GrabPay, Grab Merchant App, and Merchant Central in 85 SM malls nationwide. Our partnership with Banco de Oro and SM Malls helped scale Merchant Central.

Eventually, leadership recognized the value of the product we built for our GrabPay merchants and our GrabFood teams wanted to provide that same value to their merchants. Our product expanded to support all Grab merchants, initially with settlement, expanding as their primary Grab platform.

Grab Payment Gateway

Locations: Singapore, Indonesia, Malaysia, Vietnam, Philippines

Both Customers and Merchants Wanted to Buy and Sell Online But Leadership was Skeptical

During customer usability testing, we often heard feedback that customers wanted to buy online products, using GrabPay. Merchants also wanted to more easily sell their products online. Our solution - provide a payment gateway to support a variety of payment flows and use cases for our merchant partners.

Scrappy Team's Solution Averaged $48M/mo, Creating Buy-In from Skeptical Leadership

Our leadership was initially skeptical of the value of solving for this customer and merchant shared problem. Over the course of 5 months, our scrappy team of 1 product manager, 1 engineer, and me (designer), working at 20% capacity because it was not considered a priority problem, set out to provide three integration methods that supported three different payment flows:

Integration Methods

- Webview - Partners redirect the checkout flow to a website hosted by Grab and are returned to the partner page after authentication

- Native SDK - Partners use our mobile/web SDKs to embed the experience in their checkout flow while maintaining consumer security.

- App redirect - Partners redirect the checkout flow to our consumer app and complete the purchase in the Grab App.

Supported Payment Flows

- One Time Charge - The users authorizes a purchase, it completes or fails - that authorization can not be used again.

- Tokenization - The users saves GrabPay as a payment method in a partners system. It is available for use at the partner’s discretion.

- Recurring - The partner uses the user’s Tokenized GrabPay account to facilitate charges against the account without the user issuing a new authorization.

My role was to validate the customer need and to determine what to release first. Through iterative discovery sprints, I learned that we could quickly add value to vendors who did not have a payment page but did have a website. We decided to start there and only released a solution that supported GrabPay wallet payments with no top-up capabilities.

I also learned that some of our partnered vendors had development teams and were eager to create their own checkout flows. For those vendors, my product manager and I worked to setup a team of engineers specifically dedicated to create SDKs for these vendors to use. I also partnered with our brand team to create an Online Partner Guideline for these vendors to follow so that the checkout flows that contained Grab related artifacts remained consistent across all payment flows. This was the first time anyone at the company did this on the Grab Financial side of the house

The results were staggering. The initial release with just a web payment page and no top-up capabilities surprised our leadership with an average monthly revenue of $18 million/month with 400 partner companies. Eventually, with improvements and more sales reach, we grew that to $48 million/month. I later found out after leaving Grab that this product kept the company afloat during COVID-19.

Reflection: Perfection Is Not Necessary When Customers Want Their Problem Solved

Our initial launch of our payment gateway, had a lot of backlash within the design team. I was told that it had limited capabilities and did not even allow customers to top-up. But I shared that it did not matter, because we had paying customers ($18M/mo). Ultimately, this bought us time and leadership buy-in, allowing us to expand our product and our team.

Leadership Grew the Digital Marketplace Team Because of Payment Gateway's Success

Digital Marketplace

Eventually, Grab's payment gateway prompted the leadership to support the need for a consolidated digital marketplace. We were already supporting two digital payment solutions:

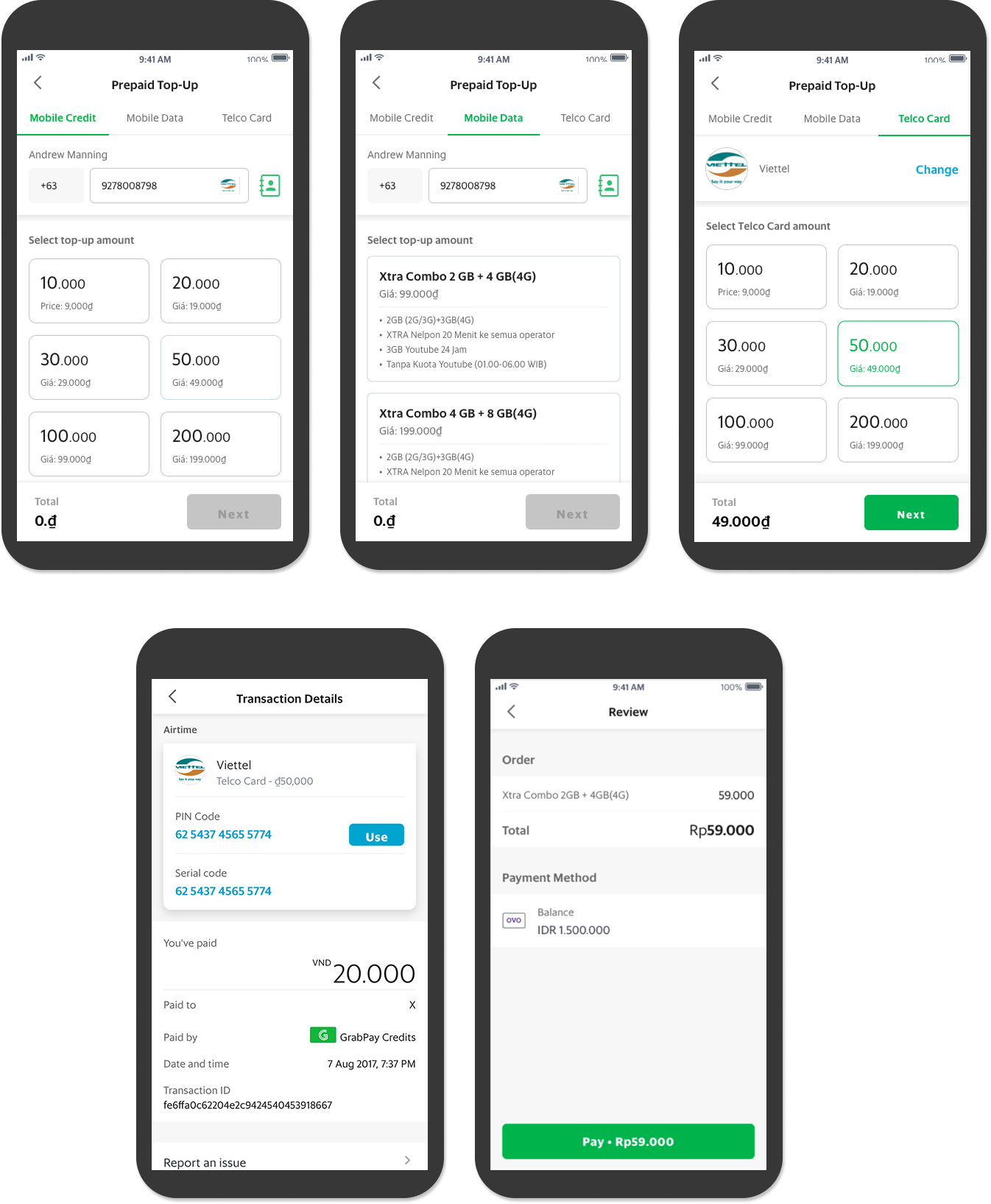

Airtime

Locations: Indonesia, Malaysia, Vietnam, Philippines, Thailand

Averaging $8M/month in revenue, Airtime was the first product added to Grab’s digital marketplace. The product had a preliminary design (from a previous designer) that needed to be faster and scale to include more prepaid airtime top-up products. Customers were spending over 10 seconds on the Select Product screen due to poor loading speed (3 seconds for the screen) and increased customer cognitive load (tabbed view made it difficult for users to know what and where to select).

To increase load speed and create more space for more prepaid options, I redesigned the original airtime from a tabbed format to separate screens, made the Select Product screen a list (to account for more products and indicate a clear call to action), consolidated all validation steps to a single Review Details screen, and ended the flow with a clear receipt, reducing the overall transaction time from 31 seconds to 18 seconds. Even though there were more screens, there was less content to load per screen (decreasing loading time) and less information for the customers to see (making it more clear what to do on each step).

Bill Pay

Locations: Singapore, Indonesia, Malaysia, Vietnam, Philippines, Thailand

Following the airtime, GrabPay expanded its services to bill payments, which contributes up to 80% of every household monthly fixed cost. Bill Pay enables Grab Users to check their bill amount and pay it using GrabPay.

In many of the supported countries, especially Indonesia and the Philippines, GrabPay customers must pay their bills manually. In Indonesia it is not unusual for customers to make time in their day to go to the local Indomart and pay their bills directly at the cash register. In the Philippines, many GrabPay customers pay their bills at a local mall’s Bayad Center which is about a 25 minute drive via a 15 peso tuk tuk ride one-way. There they will wait about 15-60 minutes before they are served to pay their bills when they are expected to present the mailed physical bill to the teller for payment.

Averaging $16M/month in sales, Bill Pay made an hour-long bill payment take less than half a minute, saving Grab customers' precious time.